Are new generation rigs cash flow safe havens with large potential upside?

How the newest tech rides out market volatility and positions you well for the next bull market

As the macro landscape has been remarkably unstable, many investors have flocked to traditional safe-haven assets. The Russian invasion of Ukraine, record-high inflation in the US, and a hawkish federal reserve have led to the price of Bitcoin falling from $69,000 to $17,600. Bitcoin has been pitched as a safe haven, but in the short term, this has clearly been proven false. Most of the price decline can be attributed to investors looking to shed risk off of their portfolio and transition to cash and blue-chip US equities. With that said, is there an alternative safe haven in the crypto space that still offers a large potential upside during the next bull market?

In Short, Yes.

Unconventional, new-generation mining rigs provide a unique opportunity for people. Because of the algorithmic supply dynamics in the Bitcoin network (difficulty adjustment), these new rigs enable miners to earn a consistent positive cash flow even in the face of extreme volatility. New-gen hardware dollar-cost averages into Bitcoin at a discount, which enables you to capture massive future potential upside.

Bitcoin’s high returns come at the expense of short-term volatility

Many people are confident that Bitcoin will outperform most asset classes on a 4+ year time horizon, but the high potential returns come at the expense of short-term volatility.

The Sharpe Ratio is a financial metric used to calculate Bitcoin’s historical risk-adjusted returns. After accounting for volatility and short-term risk, is the return justified?

Looking at a 4-year holding period, Bitcoin’s Sharpe ratio is historically almost always higher than all other major asset classes including gold, US stocks, US real estate, bonds, and emerging currencies. This chart was created by Willy Woo (@woonomic).

While the 4-year holding period Sharpe ratio validates that the large returns can justify the short-term volatility, that doesn’t mean investors want to stomach that short-term volatility.

What if it was possible to still capture a large amount of the future upside and reduce short-term volatility risk, all while earning a positive daily BTC “dividend”?

Earn a “Bitcoin dividend” during high volatility

Mining Bitcoin using the proper strategy gives investors a unique asymmetric position in the market. Purchasing new generation mining rigs during the initial phase of a hardware upgrade cycle allows market participants to reduce short-term volatility exposure while still capturing Bitcoin’s future long-term upside potential.

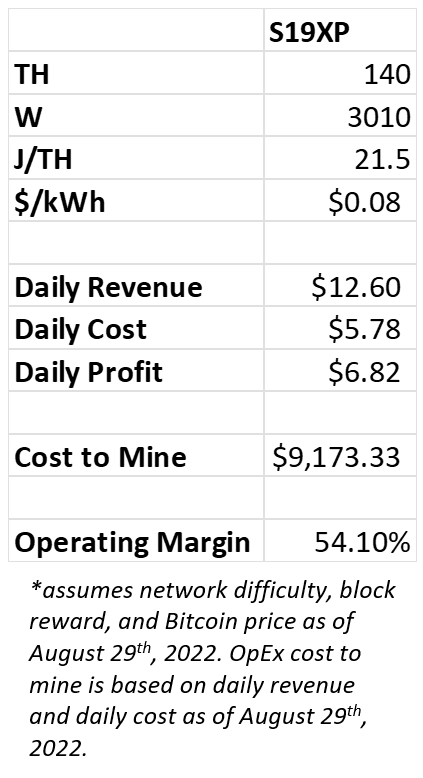

At the current price and network mining difficulty, an S19XP would have an operating margin north of 54%.

This was calculated using a BTC price of $20,000 and a hash price of $0.09 on August, 29th, 2022.

This is with the market price down ~ 71% from its all-time high and mining difficulty climbing steadily. An operating margin this high likely means the rig will be spitting off positive cash flows for a significant amount of time. There are two main reasons for this:

#1 Mining Difficulty will grow, but gradually.

First, difficulty cannot climb too fast, as millions of miners would need to be deployed. That is a lot of infrastructure and manufacturing that needs to be built out over time. While this is currently occurring, it is not occurring overnight.

#2 Old-gen rigs will turn off before new-gen rigs.

Second, the price could possibly fall further, but if it does, older machines (S9s, S17s, S19s, M20s, M30s, etc.) will turn off before new generation rigs. This would lower network difficulty and likely retain your positive cash flows.

Still capture Bitcoin’s upside potential

As mentioned at the beginning of the report, an S19XP currently has an operating margin north of 54%. Effectively, this means you can mine Bitcoin at a cost significantly below the current market price. This is a highly effective way to dollar cost average into Bitcoin.

Over the long run, more efficient machines will continue to get plugged in. As long as this is happening faster than the old inefficient hash rate is coming off the network, mining difficulty will be increasing.

However, there is little risk of network difficulty exploding quickly enough to make your S19XP obsolete overnight. Over the past 8 years, ASICs have effectively commoditized, meaning new generation machines aren’t multiples more efficient than the previous generation machines. This ultimately foreshadows that the next generation (after the XP) likely won’t be significantly more efficient. This indicates hash rate and difficulty won’t grow nearly as fast as they once did, and new generation machines today may be operating profitably for an underestimated amount of time.

Data Source: Bitcoin Mining Council

On top of your machine earning a positive cash flow, buying ASICs on dips may lead to appreciation in the asset itself. Below is the historical price of an Antminer S19. This machine went from $2,000 to $12,000 as it roughly followed the price of Bitcoin, all while earning a consistent daily “Bitcoin dividend”.

Data Source: HashRateIndex.com

Bitcoin is here to stay

Bitcoin is different from all other assets (crypto and traditional) due to its unique property of immutable scarcity. Unlike other commodities, Bitcoin has a predetermined algorithmic supply schedule that cannot be changed. No matter how many miners join the network, there will never be more than 21,000,000 BTC.

This chart displays the projected supply growth of Gold and USD compared to BTC. It normalizes all assets in BTC terms starting in 2020. BTC future supply is modeled using immutable future block subsidy halving events. Gold future supply is estimated to grow at 2.5% annually. USD (M2) is estimated to grow at 7.5% annually.

Once you recognize that Bitcoin as a monetary tool is here to stay, you need to determine how to properly allocate your portfolio to it.

A lump sum purchase into BTC works, but it is hard to time the market, and holding BTC brings in zero cash flow. Dollar-cost averaging directly into Bitcoin is attractive, but it forces you to slowly allocate from zero. Mining is particularly attractive because you purchase mining rigs that can appreciate with the price of Bitcoin and you can DCA at a discount by turning ~ $0.45 of electricity into $1.00 of Bitcoin. Of course, all of this market volatility and macro uncertainty calls into question how to successfully run a Bitcoin mining operation.

All content is for informational purposes only. This Blockware Intelligence Report is of general nature and does consider or address any individual circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal, business, financial or regulatory advice. You should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.