CME Bitcoin Futures Activity is Heating Up in 2020 - Large Holders, Volume and Open Interest Hit Record Highs in January

CME Bitcoin Futures Activity is Heating Up in 2020 - Large Holders, Volume and Open Interest Hit Record Highs in January

CME Bitcoin Futures are solely traded by institutional investors. Each CME Bitcoin Future Contract is equal to 5 Bitcoins: to trade the minimum one Contract, it will cost approximately $45,000 (BTC = $9,000). The product is designed specifically for institutions. Therefore, examining the trading activity on the CME Bitcoin Futures can provide valuable information regarding institutional participation in Bitcoin. Recently, the CME has reported some very bullish data regarding activity on their Bitcoin Futures Market, specifically:

Large Open Interest Holders (entities that hold 25+ BTC Future Contracts) achieved a record high on January 7th.

CME Volume and Open Interest are approaching record highs – levels not seen since May and June of 2019.

Figure 1 – Entities that hold 25+ Bitcoin Futures Contracts ($1,125,000+ USD Value)

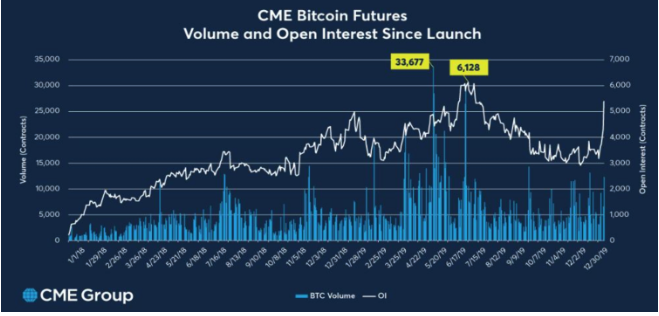

Figure 2 – Volume plus Open Interest

Figure 2 - illustrates the volume and open interest on the CME Bitcoin Futures Contracts since the product began trading in 2018. Volume refers to the number of contracts traded in a given period and open interest denotes the number of active contracts. Historically, increases in volume and open interest on CME Bitcoin futures has been a bullish indicator for Bitcoin price. The last time Volume and Open interest spiked to these levels was at the beginning of the May and June 2019 Bitcoin rallies (as illustrated in Figure 3). It indicates accelerating institutional investment in Bitcoin and appeared to be a major catalyst in the 2019 Bitcoin rally from $4,500 to $13,000+.

Figure 3

Institutions invest most heavily in the early stages of Bull Markets, while Retail participation is minimal until the later stages. CME Bitcoin Futures trading volumes continue to dwarf trading volumes on retail exchanges like Coinbase and Bitfinex (see our previous report on Institutional Investment Driving the 2019 Bitcoin Rally: https://www.blockwaresolutions.com/research-and-publications/institutional-investment-driving-the-2019-bitcoin-rally). Savvy investors follow the Institutional “smart money” as it is the big money that moves the market. A common characteristic of early Bull Markets is heavy institutional accumulation during the first ⅓ of the Bull Market cycle — which is what we are presently witnessing.

Figure 4 - Bitcoin: Estimated Cost Basis Distribution on January 19, 2020

This chart shows how most BTC in existence was last moved at a price below the current price. Coin Metrics calls this the distribution of estimated cost basis. Based off this analysis, around 72% of all Bitcoin now has unrealized gains (as of Jan 19, 2020). This is a significant improvement from one month ago where this metric stood at 50%. This demonstrates how a small increase in Bitcoin price can improve investor sentiment.