How Bitcoin Miners Adapt in a Bear Market

ABSTRACT

The sharp depreciation in Bitcoin Price has made it difficult for many mining operations to generate a profit. While this bear market has caused many facilities to close shop, experienced miners are getting creative and capturing greater market share. We are witnessing the successful miners and hosting facilities deploy innovative new strategies to gain competitive advantages through energy efficiencies; minimizing capital expenditures and operating expenditures. Improved strategies and efficiencies gained during the current market correction position market participants to lead during the next Bull Cycle. These strategies include:

Securing competitive electricity rates

Generating cash flow via Hosting & Colocation Services

Miners locking in record low hosting rates for long-term contracts

Implementing “Plug-and-Play” Container Solutions

Purchasing discounted mining rigs from secondary markets

Market Overview

The recent, sharp decline in Bitcoin Price has many questioning the long-term viability of mining. The skepticism is understandable given the fact that many North-American Bitcoin Miners are “unprofitable” at current market levels with Bitcoin below $4,000.

hosting while Bitcoin was hitting a peak of nearly $20,000 (S9 referring to the Bitmain Antminer S9: the most common ASIC mining

As witnessed by the decline in network hash rates across all major Proof-of-Work Networks, thousands of mining rigs have been taken offline [Figure 1]. Only the miners with the most attractive electricity and hosting rates continue to operate at reasonable margins. Based on market research and industry experience, Q4 2017-Q1 2018 miners were paying between $110-$150 per S9 for rig model and the default mining rig for this analysis). In Q2 and Q3 2018, $75-$85 per S9 became attractive hosting rates for mid to large scale miners and $90-$95 per S9 for retail miners. This is a sharp decline from hosting fees charged in late 2017 which were almost double current market rates [Figure 6]. Presently, during Q4 2018, miners pay hosting rates of $65-$75 per S9. With Bitcoin at $3,500 (at time of writing), miners earn a monthly revenue of $66 per S9. So those miners with an all-in operating cost above 6 cents per kWh are barely breaking even [Figure 2]. For reference, to calculate the monthly cost of running a S9 we multiplied 730 total hours per month by the kWh electricity rate by the wattage of the mining rig (on average S9 pulls 1.4 kilowatts). At a $0.06 kWh rate, the full equation is: 730 hrs x $0.06 kwh x 1.4 kw = $61.32 per month.

The new or expanding mining operation must carefully calculate capital expenditures (CapEx), which includes the cost of facility build-out and procurement of mining rigs, as well as the operational expenditures (OpEx) of running mining rigs which is primarily a function of electricity rate and capacity. This will allow a miner to properly estimate how long it will take to “earn back” their initial investment through mining rewards, as well as provide realistic profit expectations [Figure 3 and Figure 4]. A 10-14 month earn back schedule is common, while 6-8 months is ideal.

During mining rig selection, in addition to an earn back analysis, investors calculate both the Power Efficiency Ratio and the Cost per Hash Rate Ratio in order to determine the best option for their mining strategy [Figure 4]. First, the Power Efficiency Ratio, also known as Watts (W) per Terahash per second or W/TH. To calculate W/TH, you divide the mining rig wattage by the TH/s. Using an Antminer S9 14 TH/s as an example, the mining rig consumes 1400 watts, therefore 1400W / 14 TH/s = 100 W/TH. Next, the Cost per Hash Rate Ratio is calculated ($/TH). To calculate this ratio, divide the cost of the mining rig by the TH/s.

By these criteria, we have observed that the newest model is not always the optimal choice of mining rig. Upon initial release, next generation mining rigs are often radically overpriced relative to their performance improvements over the previous generation - offering an unfavorable earn back timeline compared to older models. A robust, Peer-to- Peer (P2P) Market for S9’s has emerged and undercut the manufacturers’ prices (we will elaborate further on this in a later section). At present rates, P2P sourced S9’s offers the most attractive earn back timeline; even when compared to the next generation ASIC mining rigs such as the S11, S15 and T15 models [Figure 3 and 4]. We believe this market phenomenon will continue to pressure manufacturers forcing them to lower prices on the recently released next generation mining rigs which will provide CapEx relief to growing miners.

Securing Competitive Electricity Rates

Despite current market conditions, savvy miners have increased market share while the less prepared operations are exiting the business. We have found that the most successful, experienced Bitcoin Mining Facilities have been able to thrive regardless of Bitcoin Price by utilizing flexible, long-term strategies that minimize monthly OpEx. Their success isn’t due to any competitive advantage in mining rigs given that the vast majority of mining rigs are manufactured & sold by Bitmain [Figure 5].

This longevity is attributed to the adaptability of mining operations based on market conditions; and most importantly, the minimization of OpEx related to electricity. Amateur miners often underestimate the monthly cost to house and run their mining rigs, which can be substantial. Conservatively, mining in a warehouse facility, monthly electricity costs are double the operating cost of the S9 miners themselves.1 This poses obvious difficulties in bear markets when power costs can exceed revenue. Especially for mining operations who are paying the electricity bill with their mined tokens.

It is crucial for miners to deeply understand their electricity contract with their utility: stated electricity rates, fluctuating rates based on low demand and peak times, delivered rate, the utilities ability to change your rate during the duration of the contract, and whether you have limitations on power consumption that can hinder facility expansion. This is one of the most significant risks that can devastate a hosting or mining operation. Some facilities see a stated electricity rate and do not understand that this rate is understated as it does not include delivery costs and the rate may have adjustments for peak times. Understanding your final rate is critical for budgeting purposes [Figure 8].

Unsurprisingly, miners are constantly on the hunt for the cheapest power available. Miners are increasingly utilizing power brokers to help locate the cheapest electricity and to negotiate lower and stable electricity rates with utility companies for their existing facilities. American Mining Facilities were once concentrated in the Pacific Northwest but have increasingly become location agnostic. We have observed mining operations grow across the US. Upstate NY, Ohio, Pennsylvania, Colorado, Georgia and Texas have all become popular locations.

Generating Cash Flow via Hosting & Colocation Services

Hosting and Colocation Services have also increased noticeably in the current market environment. This refers to a facility, the “Host,” renting their space to an individual or company with mining rigs, the “Miner,” to operate at the host location. The Host charges a fixed dollar rate per month, per mining rig, for what is referred to as a “Turn Key Solution.” A turn key solution is an all-in service that includes: shelf space, electricity, network connectivity, cooling, and on-site support of the mining rigs. Miners can also remotely manage their mining rigs through VPN access. The adoption of hosting services delivers additional value to large self- mining facilities that are not operating at full capacity. Hosting services minimize CapEx by eliminating the need to procure mining rigs. Hosting is a cash preserving strategy that produces a healthier balance sheet allowing hosting revenue to pay the bills while maximizing Bitcoin accumulation through self-mining, as the Bitcoin are intended to be treated as a long-term home run investment.

A large facility that self-mines is better diversified by offering hosting services. They can lock in 1-2+ year contracts with fixed rates from a miner seeking hosting services. Regardless of Bitcoin Price volatility, hosts are assured fixed monthly cash flow - although, miner credit risk must be thoroughly assessed. Miner credit risk is one of the most significant risks in the hosting service model. A facility can turn off a miner’s mining rigs if they do not make the monthly payment but cannot make up for the lost revenue. This emphasizes the importance of collecting the last 2 months payment up front and conducting the appropriate due diligence on prospective miners. Large facilities typically contract a minimum fixed payment with the utility company that they are on the hook for regardless of electricity consumption. Weaker facilities do not have strong balance sheets. They rely on their revenue to service the debt they used to build their facilities.

Implementing “Plug-and-Play” Container Solutions

Container Solutions have disrupted the traditional data center model; emerging as the most viable option for long-term miners to minimize infrastructure build out and OpEx. These Containers are specially designed shipping containers built to house and operate mining rigs with the security and redundancy of a commercial data center, eliminating the need for warehouses and most of the additional OpEx associated with them. Indoor, warehouse-style data centers with large open layouts make it difficult to properly ventilate mining rigs. The mining rigs produce excessive amounts of heat creating “hot-spots” that can damage and negatively affect the performance of the mining rigs. Our observation and criticism of indoor facilities is that the mining rigs are centrally positioned or in multiple lanes that require excessive ventilation to expel the hot air from the building.

Even small energy efficiency gains have a significant impact on annual operating expenses, especially on high power, long life cycle assets. According to an article by GE’s Director of Critical Power Applications, servers and data equipment account for 55% of the energy used by an indoor data center, followed by 30% for the cooling equipment, and around 12% by uninterrupted power supply (UPS) and electrical distribution losses. This means that the total electrical utility costs are going to be nearly double that of enters designed specifically for Bitcoin Mining have been able to reduce some of these inefficiencies, but traditional HVAC systems will still consume 20-25% or more of an indoor facility’s electricity.

A warehouse-style mining facility with 1 MW capacity would only be capable of running 400-450 S9’s due to the additional electrical consumption of the facility’s HVAC System. Additionally, purchasing and outfitting a 1 MW warehouse-style data center for mining would cost well over $300,000, and only generate half the revenue of a 1 MW container solution. This is where containers can significantly reduce both OpEx and CapEx. A 40-foot Ambient Air Container Solution is capable of running 700 S9’s off 1 MW total power capacity, for the price of $165,000. These containers come outfitted with all necessary electrical infrastructure (network gear, PDU, shelving, panels, etc). Excluding transformer and switchgear, containers offer true “plug and play” options for growing miners to substantially minimize infrastructure build out costs and OpEx.

The need for traditional, expensive HVAC systems is sizably reduced with containers or eliminated all-together. Ambient Air Container Models, like the one described above, have no need for an HVAC system, or even additional fans. On one side of the container several air intake filters cover the full 40 ft length; effectively purifying, dehumidifying, and even cooling the incoming air. The opposite wall of the container is repurposed to function as an exhaust vent, allowing hot air from the rigs to be easily expelled from the container. This design facilitates ventilation by tactically positioning the rigs in a single row along the exhaust side so that the built-in exhaust fans of the mining rigs expels hot air immediately, creating a vacuum effect which increases air-intake and ensures adequate ventilation of the mining rigs. The container’s filter intake-exhaust mechanism creates zero delta between the air temperatures inside and outside the container, resolving cooling and ventilation concerns. This type of system allows miners to generate nearly 50% greater Bitcoin Revenue of a warehouse facility with the same MW power capacity. As [Figure 7] displays, an Ambient Air Container Solution offers far greater 5-year profitability when compared to a typical Data Center or HVAC Container.

Although Ambient Air Style Containers are the most cost- efficient option, it is worth noting that some engineers believe the system may not be a viable option in warmer, humid climates. Skeptical engineers feel that in some locations, the mining rigs’ built in fans are inadequate for removing humidity and expelling heat from the container. This is the most commonly cited criticism of Ambient Air Containers and is perceived as the container’s main failure point (further down we explain how this risk is mitigated with innovative designs and improvements). In excessively warm environments, these engineers emphasize that containers may require additional fans and/or evaporative coolers (evap coolers) in order to keep the mining rigs running optimally. Even if this is the case for Ambient Air Containers, the fans and evap coolers utilized in other container solutions consume far less electricity and cost significantly less than the HVAC systems necessary in warehouse-style data centers. OpEx escalates significantly with every $0.01 increase in electricity rates so even small savings on electricity are critical for a mining operation [Figure 8].

Climate risk has become the largest criticism of the Container Strategy. Containers initially received a poor reputation as early adopters purchased low quality containers from Russia and China - allured by $30,000 price tags for 0.5 MW solutions. These containers generally fail to meet US electrical standards and much of the infrastructure deteriorates within 2-3 years. Most importantly, the lower quality, foreign made containers usually do not pass state and municipal regulations regarding electrical code and would not qualify for insurance coverage - a coveted feature demanded by miners looking to host their mining rigs at a facility. The most high-quality container designs have already addressed climate risks and durability concerns. Although containers may appear less secure or stable, rigs operating in high quality containers have maintained the same performance (hash power) and life expectancy as their counterparts running in warehouse-style facilities. The Ambient Air Container referenced previously is constructed with American-Made electrical infrastructure and has a life expectancy of 10+ years. To address climate concerns, the Ambient Air Container’s intake filter utilizes a material that absorbs and redirects moisture outside the container, decreasing the humidity. This keeps all moisture outside the container and ensures a weather-proof environment. The filter utilizes a corrugated design to ensure minimal restriction of airflow. These are reusable and washable filters that likely last for years. The filter uses a gate system to open up the entire wall (and filter) for necessary cleaning. A process requiring 10 minutes and a garden hose to complete. By operating the intake side of the container with zero delta from ambient air, the possibility of artificial dew point (a better moisture gauge than humidity) forming is eliminated. Necessary pressure gauges, humidity and temperature monitors are utilized to ensure proper operating conditions year-round. Air being pulled into the container (and subsequently, the mining rigs) is no different than air being pulled into an indoor facility via traditional HVAC & Ventilation Systems. Awnings and gutter systems also shield the container from direct exposure to the outside elements (rain, snow, hail, direct sun, excessive heat, etc.). Additional coverage, such as a large canopy tent, can be beneficial but for many containers is not necessary.

Containers also require far less time and effort to set-up as all electrical infrastructure is built into the container, including panels, cables, racks, etc. There are many variations of mining containers. Most are built custom for their unique deployment location; offering scalable, plug-and-play mining solutions wherever power is available. Containers also offer unmatched maneuverability to respond to power availability or changes in local regulation. There have been instances where new, unfavorable legislation emerges such as the moratorium on Bitcoin Mining instituted in Plattsburgh, NY - which destroyed any future for expanding mining operations in the area. The uncertainty of local regulation and unstable utility rates can upend a mining operation. Containers alleviate this critical risk to large miners and hosting facilities. They can easily be relocated, a luxury not available to warehouse-style facilities.

Purchasing Discounted Mining Rigs from Secondary Markets

The Crypto Bear Market has even extended to mining rig prices, with an almost perfectly positive correlation between the price of Bitcoin and the price of mining rigs. This characteristic of high price elasticity has provided relief for miners with ambitions to expand, as mining rig prices are 87% off highs [Figure 9].

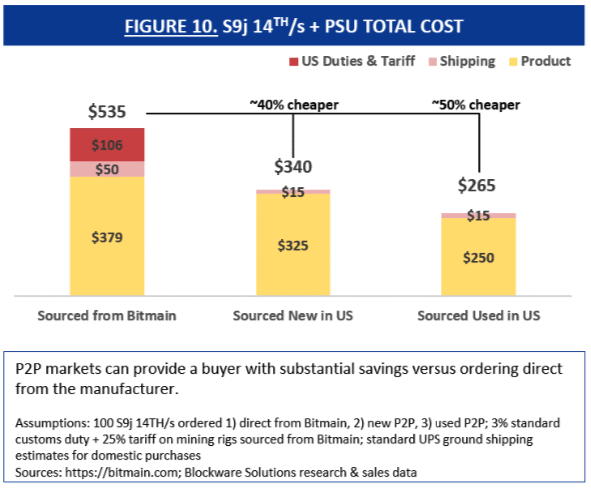

With most of the mining rigs coming from China, geopolitics, and tariffs have become a critical consideration. Several large American Miners purchased 1000’s of new S9’s at bulk discounted rates preemptively in anticipation of the enforcement of US-China Tariffs. However, their facilities and energy capacity have not grown at the pace expected at the time those purchases were made. This has forced them to take their idle mining rigs to the domestic Peer-to-Peer (P2P) Markets which have been flooded with the excess supply of both new and used mining rigs. Mining rig prices on these domestic, secondary markets have significantly undercut the manufacturer's pricing [Figure 10]. Demand for direct orders has dried up with the continued decrease in Bitcoin Price. It has proven to be much timelier and cost effective for growing facilities to purchase pre-owned mining rigs domestically rather than ordering new from China; saving approximately $100 per unit by avoiding the 25% import tariff and an additional $95 - $100 per unit on international shipping. This equates to a savings of approximately 35% on the total cost of an S9 by electing for “New Domestically located Mining Rigs.”

Used rigs are often sourced from distressed mining operations who signed misleading electricity contracts, overspent on inefficient indoor facility build outs, and/or paid highs for their mining rigs in Q1 2018 (we can assume many bought in Q1 2018 as a majority of Bitmain’s sales were in Q1). In the 1H 2018, Bitmain’s revenue was $2.845 zbillion, with a net profit of $1.123 billion. With 95% of revenue coming from the sale of 2.56 million mining rigs. However, Bitmain has been experiencing large losses recently, with a net loss of $395 million in Q2 2018.

It is worth noting, that there are inherent risks associated with purchasing used mining rigs. Manufacturer warranties for rigs sold through P2P Markets are typically at or near expiration, so conducting the proper due diligence on the mining rigs and suppliers is imperative. It can also be difficult to verify the health of a mining rig without thorough examination, so life expectancy can easily be misstated.

As mentioned previously, growing mining facilities often underestimate the time it will take to expand their operations. Lead times for the highly demanded electrical equipment (specifically transformers and switchgears) necessary to expand their facilities are often the limiting factor. The result being excess inventory of idle mining rigs and wasted CapEx at present locations. In situations such as these, miners are often left with two options: 1) sell the brand-new rigs to peers for discounted prices, or 2) locate a suitable “host” facility to remotely operate their mining rigs at another location.

MACRO-ECONOMIC CONSIDERATIONS

For new and expanding mining facilities it is important to understand that commercial and industrial real estate market development is experiencing continued high growth across the US. In July 2018, the North American crane count indicates continuous robust growth in construction activity.5 This includes college campuses across the US, who are continuing significant student housing expansion and campus development. It is likely that the new Qualified Opportunity Zone Legislation will also act as continued stimulus for real estate development nationally. We are witnessing investment dollars aggressively pour into Opportunity Zone Projects in order to shelter gains through this advantageous new tax code. An opportunity zone identifies land in a depressed city and incentivizes a fund to develop (businesses, restaurants, housing, etc) there in order to create jobs and bring money to struggling zones. An investor can fund an Opportunity Zone Investment Vehicle with established capital gains, thereby deferring tax payment on said capital gains for 10 years with the luxury of not being required to pay any taxes on subsequent gains generated from the Opportunity Zone Projects.

The above examples have created a backlog for industrial electrical equipment, particularly transformers and switchgears which are some of the most expensive components for both indoor facilities and container build outs. These components have proven to be the limiting factor on deployment times of many new builds and expansions. This is the one critical area that has not provided price relief for miners and hosting facilities. In fact, prices have been going up as the macro real estate environment is a much greater force than the Bitcoin Bear Market.

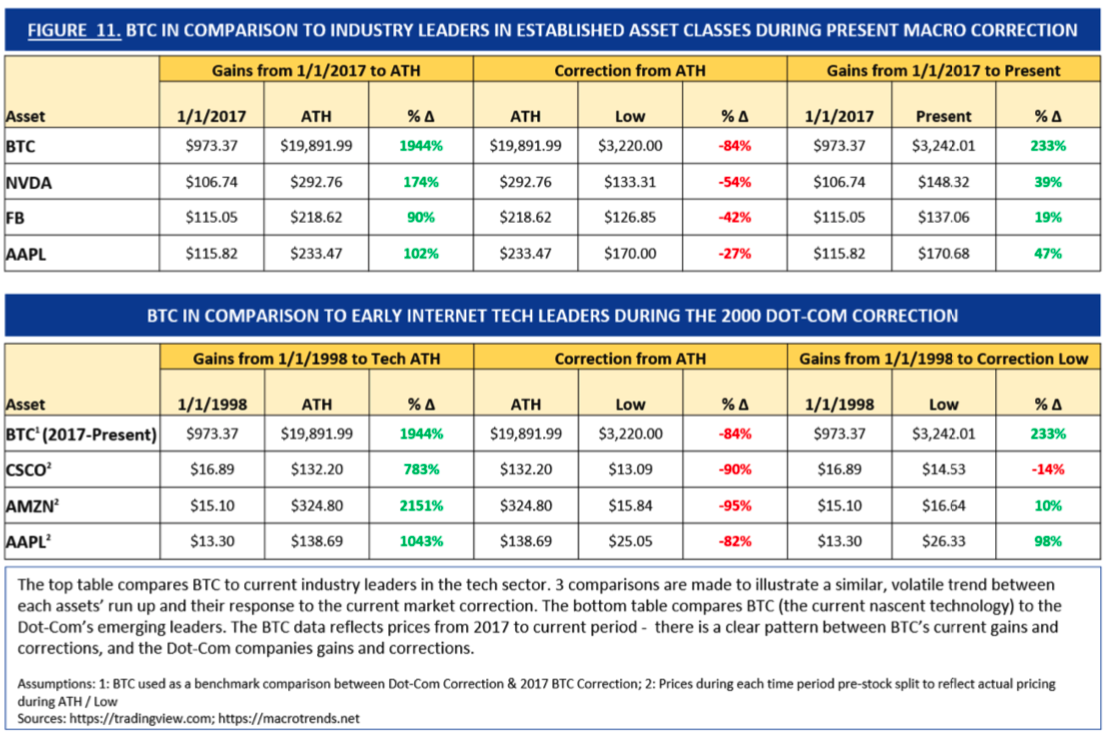

It is also important to keep in mind broader market dynamics in traditional assets. Cryptocurrencies are not the only asset class presently under pressure. Equities and traditional ‘risk assets’ appear to be entering their first bear cycle of the Quantitative Easing Era deployed by Global Central Banks. The steady decline in risk assets reflects continued concerns of slowing international growth; as US yield curve inversion and many other macro-economic indicators suggest the possibility of an incoming recession. In these conditions, we have already witnessed established and leading stocks decline by 40% or more. For new, emerging technologies, the correction in bear markets is often much more severe, as we are presently witnessing in cryptocurrencies.

To provide context on the scope of macro-economic corrections, it is worth comparing the current Bitcoin Price Correction to the price action of surviving Internet Leaders during the 2002 “Dot Com Bubble” and also compared to present leading stocks in the current correction [Figure 11]. When viewed through the lens of a macro-correction, Bitcoin is acting as to be expected for an asset in its early growth life cycle - just as AMZN, CSCO, and AAPL once did.

Many skeptics and speculators are claiming Bitcoin is dead purely based on its deep and volatile market correction. In 2002, similar assertions were directed at CSCO, AAPL, and AMZN who were also pronounced “dead” because there was too much focus on the stock price rather than the ecosystem growth, rate of adoption, and improving fundamentals. From those Dot-Com Bubble “dead lows” to present trading levels, these stocks have returned roughly 390%, 34,000%, and 32,000% respectively.

We are presently in a macro-correction and its uncertain how much lower prices will go. Many of the best stocks have already experienced 40-55%+ corrections such as Facebook and Nvidia, yet no one is pronouncing the death of social media nor the end of

Compute/AI. Of course, these companies are much more fundamentally sound and mature than the Bitcoin network. The point simply being that predicting the future of a technology solely based on price movements is unwise. Just as "Bitcoin becoming the world currency and replacing Visa" at $20,000 was foolish, "Bitcoin is dead" at $3,500 is equally as foolish.

Conclusion

The current environment is far from ideal for Bitcoin Miners, but it has ignited a wave of creativity among resourceful market participants allowing their mining operations to thrive by capitalizing on new cost-efficient strategies. A commitment to developing locations where the cheapest, most stable, long-term electricity rates are available minimizes a facility's largest expense: electricity. The evolution of Mining Facility designs has moved away from traditional data centers to mining-focused warehouse-style data centers and ultimately to container solutions. This pivot has reduced OpEx and also provided the flexibility to establish operations wherever cheap land and power exist. More importantly, container solutions avoid the significant upfront CapEx required of repurposing buildings or constructing a large indoor facility. With the container method, far less electricity is consumed on cooling and ventilation, allocating greater electrical capacity towards running a larger number of mining rigs - a powerful multiplier on profitability, as expenses are converted to revenues.

Individuals that thoroughly shop the best deals to source their mining rigs through a presently robust, domestic P2P Market will greatly reduce their CapEx and can shorten their earn back timeline by as much as 50%. Warehouse and container infrastructure costs have not fallen with the price of Bitcoin, as a result, large miners are filling out their excess capacity with hosting contracts to generate additional revenue. This creates opportunity for individual miners on the other side of the contract who are capitalizing on the ability to lock in record low hosting rates which keep them at or above breakeven with current Bitcoin Prices. Many miners are taking a long-term approach by locking in 1-2+ year contracts, which can significantly pay off once the market recovers because the miner will have secured fixed, Bear Market low rates while future hosting fees will increase significantly for new contracts.

Mining Bitcoin while the price is trending sideways or downward are the best conditions for miners with a fair to strong balance sheet. Miners have the ability to accumulate Bitcoin below the cost of purchasing a bitcoin on exchange, but an investor who owns a bitcoin generates zero to negative yield in a sideways or downward market. For a miner presently entering the space they are locking in hosting rates 50%+ off highs (main OpEx) and purchasing equipment 87% off its highs (main CapEx). This value is akin to purchasing bitcoin at $3500 rather than $13,000+. As long as the miner has a long-term investment timeline, we believe the current bear market is offering a rare opportunity. During a raging bull market, one is best positioned to purchase bitcoin instead of procuring mining rigs as the price appreciation in bitcoin generates a much better yield than a mining rig will produce over the same timeframe. In that environment, a miner would be best served taking the CapEx spent on mining rigs and investing directly in Bitcoin. We believe this downwards/sideways market will eventually lead to a new bull cycle but these conditions can persist for quite some time. For miners, the opportunity is now. Those who are able to steadily accumulate Bitcoin at present rates will be best positioned. As devastating as this Bitcoin Bear Market has been, we are optimistic that many large self-mining facilities, hosting facilities and individual miners will survive and radically prosper if and when the market recovers (as we believe it will). With every Bear Market Cycle, regardless of the asset class, inefficient operations will go under while the leading market participants innovate and establish a long-term competitive advantage. We are presently witnessing this dynamic among Bitcoin Mining Market Participants. While many continue to focus on the perceived “death spiral” of Bitcoin mining profitability, a resilient, committed network of miners continue to adapt and thrive despite difficult conditions, strengthening the security of and adding value to the Bitcoin Network.

Blockware Solutions, LLC is a Blockchain Service Provider and industry leader in Bitcoin & Cryptocurrency Mining Services. Assisting clients with the acquisition & sale of mining rigs direct from foreign manufacturers and through trusted P2P domestic channels. Blockware provides access to a thoroughly vetted network of hosting & colocation facilities across the US. Additionally, Blockware Solutions is a professional mining pool operator and also provides research / consulting services on a variety of other opportunities in the Blockchain and Cryptocurrency Mining Space.

Blockware is a team with professional experience in Director Level Corporate Finance, Proprietary FX Trading, and Management Consulting. Co- Founder Matt D’Souza currently manages Blockchain Opportunity Fund, LLC: a mid-large size hedge fund focused solely on digital assets and the blockchain space. He is presently being engaged by a Private Equity firm to be the CEO of a 120 MW self-mining and hosting facility.

Blockware Solutions presently operates one of the largest AION Mining Pools and is working with the Loom Team to launch a Validator (Staking) Pool, and consistently positioning for new ways to actively support growing blockchain ecosystems.

We are always looking to network, learn and educate. We appreciate any feedback and look forward to a continued discussion!

https://BlockwareSolutions.com

Follow us on Twitter: @BlockwareTeam and @Mjdsouza2

For direct comments or questions, email us at Contact@BlockwareSolutions.com

Co-Authored by: Sam Chwarzynski, Chris D’Souza, Matt D’Souza and Mason Jappa

Special thanks to Scott Bennett at Scate Ventures, Ro Shirole at Compute North, and George McDermand, inventor of the Mouse Pad / 5 years of mining and cryptocurrency experience for their continued support & education!