Why the 2020s will be a Golden Age for Bitcoin Mining

Historically, Bitcoin’s hash rate has grown significantly faster than price. In 2013 alone, hash rate grew by over 65,000% while price grew 3,825%. Both metrics are clearly growing exponentially, but historically hash rate has grown significantly faster than price. Even as the price fell -74% in 2014, hash rate grew almost 2,000%.

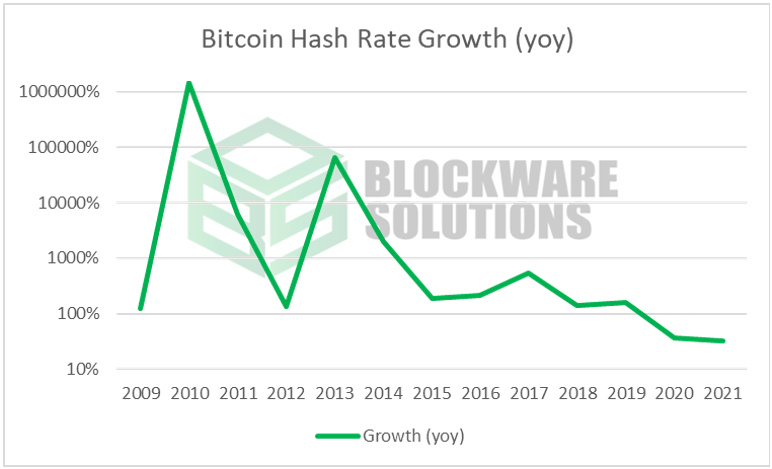

Looking at hash rate growth numbers year over year, we can clearly see a powerful downtrend even when the y axis is transformed to log scale. The previous 2 years of hash rate growth were only 37% and 32% respectively. These are the lowest hash rate growth numbers ever, and interestingly, both years saw positive price growth.

Price Appreciation will Outpace Historical Hash Rate Growth

Blockware Solutions research believes that this is not a temporary trend. Bitcoin will likely not see massive hash rate growth (on a percentage basis) anytime soon, if ever again.

This is ideal for new and existing miners. If hash rate doesn’t grow at the exponential rate that it once did, then the rigs miners buy today can stay profitable for longer periods of time and retain their value as well.

Let’s dive into what is driving the price of Bitcoin up and what is keeping hash rate growth muted.

What is Driving Price Up?

Public Markets Removing Natural Sell Pressure

As we discussed in our 2020 research report, miners are the main driving force of sell pressure on the Bitcoin Network. They receive all of the newly issued Bitcoin and they must sell Bitcoin in order to fund CapEx and OpEx for their mining operation.

With the growing institutionalization of Bitcoin, Bitcoin miners are beginning to tap into public equity and debt markets. Unlike before, companies mining Bitcoin at scale are able to capitalize on cheap financing to build and operate large mining facilities without selling their Bitcoin.

This means a significant amount of Bitcoin’s hash rate now has the ability to finance their operating expenses and hold all of the Bitcoin they mine. Consequently, there is increasingly less selling pressure (new coins) as these public firms bring on more and more hash power.

Our previous research published at the end of November 2021 shows that public firms are estimated to bring on at least 56.5 EH/s of hash rate. This is ≈ 34.7% of the total current hash rate. This will be a significant amount of future newly mined coins not being sold.

https://www.blockwaresolutions.com/research-and-publications/how-public-miner-asic-orders-will-affect-hash-price-th-and-Bitcoin-adoption

In addition to public mining firms leveraging debt and public equity markets at scale to accumulate more Bitcoin, other publicly traded companies like Microstrategy are adding Bitcoin to their balance sheet at scale. Removing even more liquidity from the market as they do not intend to sell their BTC.

Corporations like Microstrategy are in a way, synthetic Bitcoin miners. They are able to borrow money at very cheap interest rates to purchase Bitcoin, effectively taking even more Bitcoin off the market, driving the price higher.

In fact, as of November 30th, 2021, $MSTR has bought more than 26% of Bitcoin’s daily issuance since it first started buying in 2020.

Small Mining Firms Sourcing Non-Scalable Cheap Energy

In addition to public mining firms and public companies sucking Bitcoin off the market, a growing segment of Bitcoin miners is finding creative ways to operate ASICs at sub $0.02 per kWh. A good example of this is natural gas miners like Giga Energy.

As miners, they are bullish on Bitcoin, but they are able to mine it at such cheap electricity prices that the sell pressure they add to the market is very minimal. Since they are smaller firms, they are unable to access public markets to raise capital to fund their operations, but their creative thinking and resourcefulness for cheap energy enables them to stack and hold a large majority of the Bitcoin they mine.

Note: The amount of sub $0.02 kWh available in the world is very small, however Bitcoin miners will likely eat up a large portion of this excess (would be wasted) energy. The limited availability of this energy limits the amount of hash rate growth that can come from it, but the miners that do find it will be highly profitable and will not need to sell much Bitcoin to fund their operations.

Data Supports Less Miner Selling

This is not just theory. As more and more miners get access to public financial markets and smaller miners utilize all of the scattered cheap energy, miners are selling less Bitcoin. Glassnode data supports this thesis.

Looking at the 30 day moving average of total miner revenue, miners are pulling in a fair amount of coins every day (currently more than $50M per day).

However, the 30 day moving average of transfer volume from miners to exchanges has dropped significantly since the start of 2021. It is even approaching levels not seen since 2020 when the price was below $20,000.

This relationship is better visualized using a Miner Sell Pressure Ratio (Transfer Volume from Miners to Exchanges / Total Miner Revenue). The trend is clear and the ratio currently sits at about 10%, meaning 1 in 10 coins mined gets sent to exchanges (presumably to be sold).

Holding all other factors equal, lower Miner Sell Pressure should result in a higher Bitcoin price.

What is Slowing Hash Rate Growth?

Markets are constantly trending towards efficiency, but there is clearly a dislocation in the Bitcoin mining industry. Mining profits are high, but hash rate is only increasing slowly.

https://insights.braiins.com/en/

Currently, nearly every model ASIC produced since 2016 is highly profitable (at $0.05 kWh electricity rate), and has a high breakeven electricity price. What’s preventing these high profit margins from compressing other than the fact that the price of Bitcoin is going up so fast?

Hash rate growth is one key factor that could eat into these profits. As more miners join the network, they are all still competing for the same amount of Bitcoin. However, as noted at the beginning of this research report, hash rate growth is slowing. This slowing growth in hash rate is caused by two main factors.

ASIC Commoditization / ASIC Manufacturing Game Theory

Lack of Scalable Cheap Energy

ASIC Commoditization

New machines will no longer be 100x more efficient within a couple years. Looking at the chart below, ASICs have become increasingly more efficient on a J/TH basis. Meaning over time, ASICs can create more TerraHashes from less energy. However, the marginal increase in efficiency is slowing significantly.

https://bitcoinminingcouncil.com/wp-content/uploads/2021/10/2021.10.19-Q3-BMC-Presentation-Materials-Final.pdf

The recent marginal efficiency increases, compared to the 700x or 13x increases we saw in the past, have and will continue to significantly decrease the speed at which future hash rate grows.

A new generation ASIC being deployed will no longer add as much hash rate (relative to the total existing network hash rate) as a new machine did in the past.

Lack of Scalable Cheap Energy

If the price of Bitcoin continues to appreciate exponentially and ASICs continue to be commoditized, then it will become clear over the next 8 years that a major bottleneck to hash rate growth is simply the access to scalable cheap energy.

The issue with energy production being a bottleneck is that companies cannot spin up energy production facilities (like a large nuclear power unit) overnight. A Stanford research report states, “according to the Nuclear Energy Agency (NEA), it takes about five to seven years to build a large nuclear unit.” Additionally, even large solar farms will take a minimum of two years to fully complete from start to finish.

Bitcoin mining is still such a new growing industry that we haven’t seen new energy production facilities built for the specific purpose of mining Bitcoin. The price of Bitcoin combined with profitable mining needs to be elevated for a longer period of time for energy providers to consider developing new plants for this use case.

Bitcoin will require the cheapest (likely most renewable) sources of energy to expand by orders of magnitude. With US primary energy consumption being relatively stagnant for the last 20 years, a significant amount of new infrastructure would need to be built out to keep pace with the historical growth in hash rate. It would be a shock to the industry to have to produce more energy in order to power the soundest monetary asset of all time through its energy intensive proof of work consensus mechanism. As stated above, energy production cannot grow immediately, and a lack of cheap scalable energy will continue to be a bottleneck for miners.

https://en.wikipedia.org/wiki/Energy_in_the_United_States#/media/File:US_energy_consumption.svg

In general, Bitcoin’s hash rate will continue to grow. There’s no question about that, especially if the price goes considerably higher over the next 8 years. The main point is that hash rate will no longer be growing by 500% per year due to ASIC commoditization and a lack of available cheap energy at a large scale.

Why Start Mining Now?

With new generation ASICs only being slightly more efficient, older ASICs now remain more competitive for a longer period of time. This means ASICs you purchase today will remain competitive for more than just a couple of years. It’s possible that S19s remain competitive until 2030 due to future ASICs not being significantly more efficient and the general deceleration in hash rate growth. The key is that new machines will retain their value and be more profitable for a longer period of time.

Over 1 Million Coins Will Be Mined Before 2030

There are still over 1 million coins to be mined before 2030. After 2030, there will be less than 500,000 new Bitcoins mined until 2140 (the end of the block subsidy).

Bitcoin is in a unique phase where the price is high and the block subsidy is still relatively high. This is why the 2020s are going to be a golden age for Bitcoin mining.

Potential Increase in Fees

Transaction fees are another important factor to consider when identifying whether Bitcoin mining is a good investment to allocate capital to. It’s not commonly discussed, but if Bitcoin adoption does rapidly advance, then onchain fees could increase rapidly and become a significant portion of mining revenue. These onchain fees could include simply moving coins from hot to cold wallets but also include Bitcoin native DeFi. Alternative chains are seeing DeFi create significant onchain fees to use the network. If the adoption of Bitcoin native DeFi continues, then network fees (paid to miners) would likely increase as well.

Conclusion

The 2020s have been and will continue to be a golden age for Bitcoin mining. It’s an ideal strategy to deploy significant capital into the industry in order to accumulate as many coins as possible if you have a long time horizon.

If you are interested in purchasing ASICs with or without hosting, reach out to us here, and also consider reading our ASIC & Bitcoin Mining Purchasing Guide published back in 2020.