Bitcoin Energy Gravity

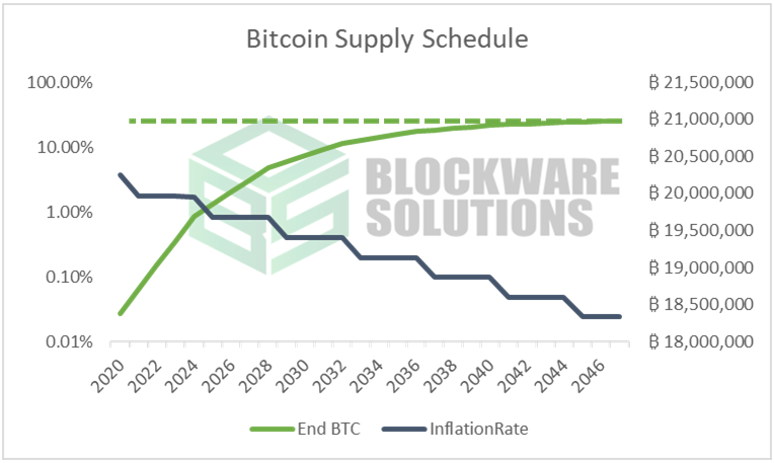

This Blockware Intelligence Research Report models the relationship between the price of Bitcoin and its mean operating cost of production for modern mining rigs.

It demonstrates how this relationship plays an important role in Bitcoin price cycles and the long-term monetization of the asset.

Read More

Bitcoin User Adoption Report

Societal adoption of disruptive technologies is never a linear process – it has always followed an exponential S-Curve pattern. Bitcoin is a disruptive technology network that is quantifiably still in its early stages of adoption. In addition to examining the most pertinent Bitcoin user growth data and its historical relation to Bitcoin price, this report proposes a conceptual framework for forecasting future Bitcoin adoption in the context of past disruptive technology adoption cycles.

Read More

Bitcoin is Certainty in an Uncertain World

This Blockware Intelligence Research Report contrasts the certainty provided by Bitcoin’s immutable scarcity with the macroeconomic uncertainty associated with record-high inflation.

We examine the historical impact of high inflation on the performance of various traditional asset classes including commodities, fixed income, & equity markets. In doing so, we will illustrate the similarities and superiorities of Bitcoin compared to every other asset class in this unrestrained inflationary environment to make it clear that Bitcoin is not simply a commodity, but a disruptive network technology and the ultimate savings vehicle.

Read More

New Generation Mining Rigs Are Safe Haven “Bitcoin Dividend” Assets

As the macro landscape weighs on markets all over the world, many investors are flocking to traditional safe-haven assets. The Russian invasion of Ukraine, record-high inflation in the US, and a hawkish federal reserve have led to the price of Bitcoin falling from $69,000 to $38,000. While unconventional, new-generation mining rigs provide a unique opportunity for investors. Because of the algorithmic supply dynamics in the Bitcoin network (difficulty adjustment), these new rigs enable miners to earn a consistent positive cash flow even in the face of extreme volatility. Last, your machine dollar-cost averages into Bitcoin at a discount, which enables you to still capture massive future potential upside.

Read More

Why Now Is The Time To Get Started With Crypto Mining With Guest Mason Jappa Co-Founder of Blockware Solutions

Listen to Mason Jappa (CEO of Blockware Solutions) discuss Bitcoin mining, PoS validators, and how Blockware helps clients buy and sell mining rigs directly from international manufacturers and through trusted peer-to-peer networks.

Read More

Valuing Public Bitcoin Miners on Their Hash Rate

Billions of dollars are currently flooding into public Bitcoin mining companies. They are able to raise a significant amount of capital for two key reasons. First, these are high-growth technology companies that actually spin-off a positive cash flow. This is a stark contrast to the unprofitable high growth names that peaked in 2021 like Uber, Zillow, and Robinhood. Second, many traditional firms may not be able to buy Bitcoin directly, so they invest in related equities to get proper exposure.

Read More

Blockware Solutions 2021 Year in Review

2021 was another exciting year for global Bitcoin adoption. Fresh off the cross through $20,000 in December 2020, Elon Musk announced the addition of $1.5 billion in Bitcoin to Tesla’s balance sheet. This news was enough to see Bitcoin’s market capitalization surpass $1 trillion for the first time on February 19th.

Read More

Anthony Pompliano's Summary of the Blockware Solutions 2021 Year in Review Report

Anthony Pompliano reviews the Blockware Solutions 2021 Year in Review Report by the Blockware Intelligence team.

Read More

Why the 2020s will be a Golden Age for Bitcoin Mining

The 2020s have been and will continue to be a golden age for Bitcoin mining. It’s an ideal strategy to deploy significant capital into the industry in order to accumulate as many coins as possible if you have a long time horizon.

Read More

How Public Miner ASIC Orders will Affect Hash Price ($/TH) and Bitcoin Adoption

Public bitcoin mining firms ($RIOT, $MARA, $HUT, and others) are bringing on significant hash power to the Bitcoin network in 2022.

Read More

Bitcoin Mining Panel: Energy Efficiency and Economic Utility | Digital Asset Summit New York 2021

A panel from the Digital Asset Summit 2021 in New York City featuring Blockware Solutions’ CEO Mason Jappa discussing the ESG narrative, regulations, future outlooks, and more.

Read More

Public-Key Cryptography: Road to Bitcoin Smart Contracts #3

This article hopes to:

1) Investigate Public Curve Cryptography in a manner that is self-contained.

2) Explore cryptographic concepts and problems through visual aids without assuming advanced knowledge of the mathematics underlying the subject.

Read More

Introduction to Cryptography: Road to Bitcoin Smart Contracts #2

This article hopes to:

1) Provide an introduction to cryptography in a manner that is self-contained.

2) Explore cryptographic concepts and problems through visual aids without assuming advanced knowledge of the mathematics underlying the subject.

Read More

The Story And Facts About Cryptocurrency | Mara Wealth w Blockware Solutions | Traders Mindchat Show

Everyone’s talking about Crypto! But what really is crypto and how much of your portfolio should be invested in cryptocurrency…such as Bitcoin or even the Dogecoin hype? In today’s episode of “The Trader’s Mindchat Show,” Mara Wealth’s Mike & Melissa chat with Blockware Solutions co-founder Sam Chwarzynski to discuss what cryptocurrency is and why now is the perfect storm for Bitcoin.

Read More

Bitcoin 2021: How To Build A (Profitable) Bitcoin Mine

Join Dave Perrill, Mason Jappa, Harry Sudock, Greg Ohanessian and Jesse Peltan from Bitcoin 2021 as they discuss "How To Build A (Profitable) Bitcoin Mine."

Read More

A Trustless and Truthful Revolution: Road to Bitcoin Smart Contracts #1

This article is the first in a series of twenty-one articles that will:

1) Articulate the importance and potential impacts of smart contracts on the Bitcoin and Lightning networks.

2) Introduce and explain the technical tools that will be needed to appreciate the power and utility of smart contracts.

Read More

Tales From The Crypt #231: Mining trends, bitcoin liquidity crunch, and money printer go brrr with Mason Jappa & Sam Chwarzynski

Join Marty as he sits down with Mason Jappa & Sam Chwarzynski from Blockware Solutions to discuss:

- Mining trends

- Hosting

- Bitcoin as a messaging protocol

- The bitcoin liquidity crunch

- The macro factors lining up for bitcoin

- Bitcoin the messaging network

- Protecting against onerous regulations

- much more

Read More

Noded Podcast: 78 - With Mason Jappa

Mason Jappa the CEO of Blockware Solutions joins Pierre Rochard and Michael Goldstein on the Noded Podcast to discuss the latest trends in bitcoin mining, the future of Bitcoin, and the services his company provides.

Read More

The Pomp Podcast #476: Mason Jappa on The State of Bitcoin and Mining

Mason Jappa is the cofounder and CEO of Blockware Solutions, a blockchain infrastructure company and network advisory firm.

In this conversation, we discuss the latest Blockware research report on Bitcoin, including why $40,000 is just the beginning and how the network metrics suggest Bitcoin is stronger than ever.

Read More

2021 Bitcoin Market Outlook - $40,000 is Only the Beginning

As Bitcoin price continues to make new highs in 2021, it is imperative to understand that the current Bull Cycle (March 2020 - Present) has been, and continues to be, disproportionately driven by institutional investment, while retail investors have remained slow to participate. This is a powerful signal that the present Bitcoin Bull market is still in its early stages. A key characteristic of early Bull Market’s is heavy institutional accumulation during the early stages of the Bull Market. We are presently witnessing this unfold in Bitcoin.

Read More