Using conservative assumptions, mining Bitcoin outperformed holding Bitcoin through 2021. When most investors think about mining Bitcoin, they forget that Bitcoin mining is not only about generating operating income, but it also involves purchasing a valuable asset - Bitcoin ASICs.

Read MoreAll financial markets are driven by human behavioral dynamics, which is why similar patterns are repeated across markets, asset classes and time. These recurring patterns define the secular phases of the market cycle and create the foundation for examining the driving forces in every asset class through periods of expansion and contraction.

Utilizing the framework highlighted by this report, within the present macroeconomic context, can provide valuable signals to help investors more effectively allocate capital.

Read MoreThis Blockware Intelligence Research Report models the relationship between the price of Bitcoin and its mean operating cost of production for modern mining rigs.

It demonstrates how this relationship plays an important role in Bitcoin price cycles and the long-term monetization of the asset.

Read MoreSocietal adoption of disruptive technologies is never a linear process – it has always followed an exponential S-Curve pattern. Bitcoin is a disruptive technology network that is quantifiably still in its early stages of adoption. In addition to examining the most pertinent Bitcoin user growth data and its historical relation to Bitcoin price, this report proposes a conceptual framework for forecasting future Bitcoin adoption in the context of past disruptive technology adoption cycles.

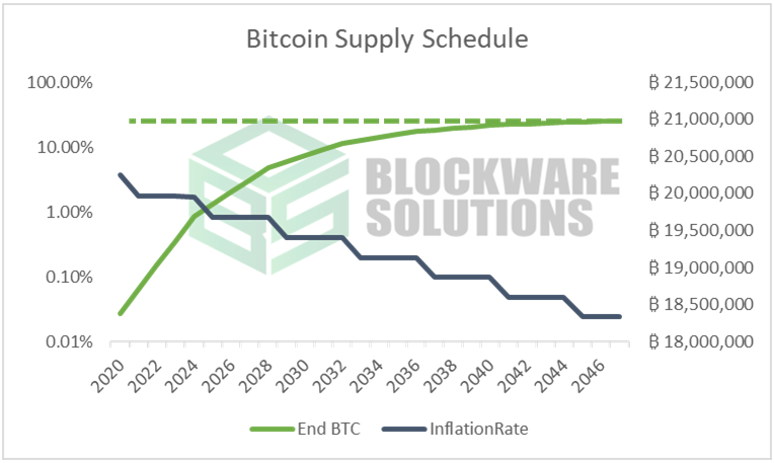

Read MoreThis Blockware Intelligence Research Report contrasts the certainty provided by Bitcoin’s immutable scarcity with the macroeconomic uncertainty associated with record-high inflation.

We examine the historical impact of high inflation on the performance of various traditional asset classes including commodities, fixed income, & equity markets. In doing so, we will illustrate the similarities and superiorities of Bitcoin compared to every other asset class in this unrestrained inflationary environment to make it clear that Bitcoin is not simply a commodity, but a disruptive network technology and the ultimate savings vehicle.

Read MoreAs the macro landscape weighs on markets all over the world, many investors are flocking to traditional safe-haven assets. The Russian invasion of Ukraine, record-high inflation in the US, and a hawkish federal reserve have led to the price of Bitcoin falling from $69,000 to $38,000. While unconventional, new-generation mining rigs provide a unique opportunity for investors. Because of the algorithmic supply dynamics in the Bitcoin network (difficulty adjustment), these new rigs enable miners to earn a consistent positive cash flow even in the face of extreme volatility. Last, your machine dollar-cost averages into Bitcoin at a discount, which enables you to still capture massive future potential upside.

Read MoreListen to Mason Jappa (CEO of Blockware Solutions) discuss Bitcoin mining, PoS validators, and how Blockware helps clients buy and sell mining rigs directly from international manufacturers and through trusted peer-to-peer networks.

Read MoreBillions of dollars are currently flooding into public Bitcoin mining companies. They are able to raise a significant amount of capital for two key reasons. First, these are high-growth technology companies that actually spin-off a positive cash flow. This is a stark contrast to the unprofitable high growth names that peaked in 2021 like Uber, Zillow, and Robinhood. Second, many traditional firms may not be able to buy Bitcoin directly, so they invest in related equities to get proper exposure.

Read More2021 was another exciting year for global Bitcoin adoption. Fresh off the cross through $20,000 in December 2020, Elon Musk announced the addition of $1.5 billion in Bitcoin to Tesla’s balance sheet. This news was enough to see Bitcoin’s market capitalization surpass $1 trillion for the first time on February 19th.

Read MoreAnthony Pompliano reviews the Blockware Solutions 2021 Year in Review Report by the Blockware Intelligence team.

Read MoreThe 2020s have been and will continue to be a golden age for Bitcoin mining. It’s an ideal strategy to deploy significant capital into the industry in order to accumulate as many coins as possible if you have a long time horizon.

Read MorePublic bitcoin mining firms ($RIOT, $MARA, $HUT, and others) are bringing on significant hash power to the Bitcoin network in 2022.

Read MoreA panel from the Digital Asset Summit 2021 in New York City featuring Blockware Solutions’ CEO Mason Jappa discussing the ESG narrative, regulations, future outlooks, and more.

Read MoreThis article hopes to:

1) Investigate Public Curve Cryptography in a manner that is self-contained.

2) Explore cryptographic concepts and problems through visual aids without assuming advanced knowledge of the mathematics underlying the subject.

Read MoreThis article hopes to:

1) Provide an introduction to cryptography in a manner that is self-contained.

2) Explore cryptographic concepts and problems through visual aids without assuming advanced knowledge of the mathematics underlying the subject.

Everyone’s talking about Crypto! But what really is crypto and how much of your portfolio should be invested in cryptocurrency…such as Bitcoin or even the Dogecoin hype? In today’s episode of “The Trader’s Mindchat Show,” Mara Wealth’s Mike & Melissa chat with Blockware Solutions co-founder Sam Chwarzynski to discuss what cryptocurrency is and why now is the perfect storm for Bitcoin.

Read MoreJoin Dave Perrill, Mason Jappa, Harry Sudock, Greg Ohanessian and Jesse Peltan from Bitcoin 2021 as they discuss "How To Build A (Profitable) Bitcoin Mine."

Read MoreThis article is the first in a series of twenty-one articles that will:

1) Articulate the importance and potential impacts of smart contracts on the Bitcoin and Lightning networks.

2) Introduce and explain the technical tools that will be needed to appreciate the power and utility of smart contracts.

Read MoreJoin Marty as he sits down with Mason Jappa & Sam Chwarzynski from Blockware Solutions to discuss:

- Mining trends

- Hosting

- Bitcoin as a messaging protocol

- The bitcoin liquidity crunch

- The macro factors lining up for bitcoin

- Bitcoin the messaging network

- Protecting against onerous regulations

- much more

Read MoreMason Jappa the CEO of Blockware Solutions joins Pierre Rochard and Michael Goldstein on the Noded Podcast to discuss the latest trends in bitcoin mining, the future of Bitcoin, and the services his company provides.

Read More